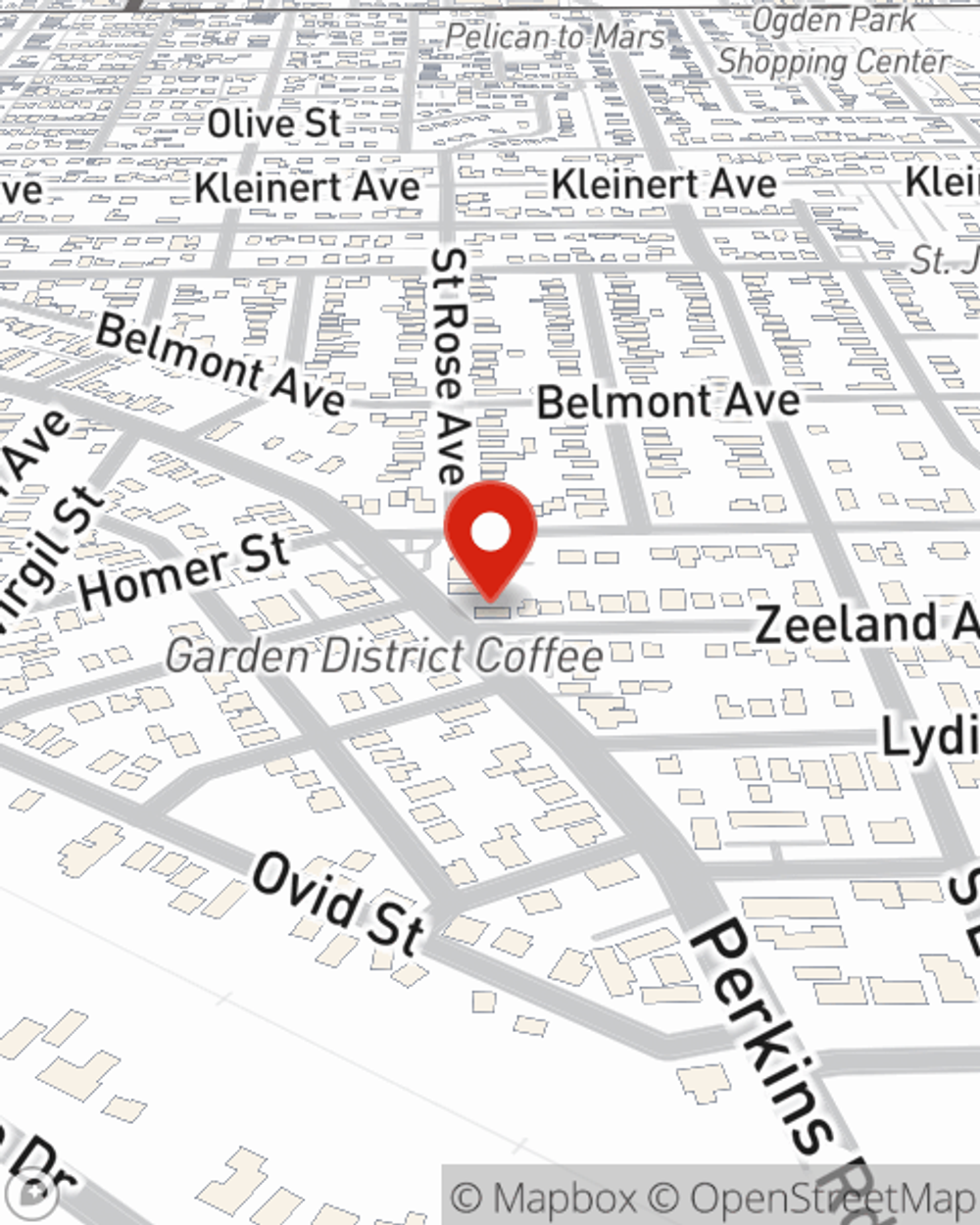

Business Insurance in and around Baton Rouge

Searching for protection for your business? Search no further than State Farm agent Joe Skibinski!

Almost 100 years of helping small businesses

Your Search For Outstanding Small Business Insurance Ends Now.

When experiencing the wins and losses of small business ownership, let State Farm be there for you and help provide great insurance for your business. Your policy can include options such as errors and omissions liability, extra liability coverage, and a surety or fidelity bond.

Searching for protection for your business? Search no further than State Farm agent Joe Skibinski!

Almost 100 years of helping small businesses

Small Business Insurance You Can Count On

When you've put so much personal interest in a small business like yours, whether it's a tailoring service, a HVAC company, or an art gallery, having the right coverage for you is important. As a business owner, as well, State Farm agent Joe Skibinski understands and is happy to offer exceptional service to fit your needs.

Get right down to business by getting in touch with agent Joe Skibinski's team to talk through your options.

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Joe Skibinski

State Farm® Insurance AgentSimple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.